From the CIO’s desk - A note on the markets

Dear investors,

As we look back on the last few weeks, it’s noticeable that markets were complacent about the coronavirus (COVID-19) when it first started to spread outside China. Many assumed since China was controlling the situation that other countries would be better prepared to handle the spread of the virus in their respective countries. Markets became more volatile upon the realization that most countries were not prepared to contain the virus.

We encourage investors to hold a diverse portfolio of investments to help spread out their risk. When you’re investing for the long-term, you can ride out these periods of volatility by staying the course rather than trying to jump out of, then back into, the market. Success in investing not only requires enough pessimism to prevent complacency, but also sufficient optimism to give hope. During these times, investors need to battle their emotions and focus on their long-term goals.

It’s been found that stock prices are affected mainly by two things:

1. Fundamentals, such as the outlook for earnings, cash flow and balance sheet metrics.

2. Psychology, how investors feel about the fundamentals.

Stock prices clearly fluctuate much more than earnings and cash flow. The main reason is not because fundamentals change so much but human behaviour is influenced by psychological and emotional reasons.

How to judge the mood of the market?

Professional investors consider fundamentals and valuations (price-to-earnings, dividend yield, price-to-book) to inform whether the market is at bargain levels. Of near equal importance we believe are qualitative and non-quantifiable factors like the mood of the market. The following are used as gauge, e.g., media reporting of economic conditions (optimistic or pessimistic), stock, bond and currency market volatility, the level of risk appetite implied by market commentary, description of financial conditions, and discussion on market scenarios.

Markets have gone from complacency to capitulation. Year-to-date, global stock markets are down by more than 20%.

Before COVID-19, we were experiencing the longest bull market in US history (2009-2020). Today, we are at the other end of the spectrum with commentary about economic contraction and worries about financial dislocation. This is an over-reaction and would correct over time as we get more data. The truth is somewhere between the extremes.

A framework to think about the crisis

Source: UBS, March 2020.

The world is now aggressively combating Covid-19: With a 24/7 news cycle, the world is watching just how fluid the coronavirus situation remains. Measures are being put in place to help flatten the curve, revive economies and help markets confidently put the COVID-19 virus behind us. The market mood does not indicate certainty but influences the probability of reading markets correctly. That is useful, nonetheless. The way we see it, there is a good probability of profiting from the current depressed market sentiment. We believe the impact on economies may last till September with recovery beginning in the fourth quarter.

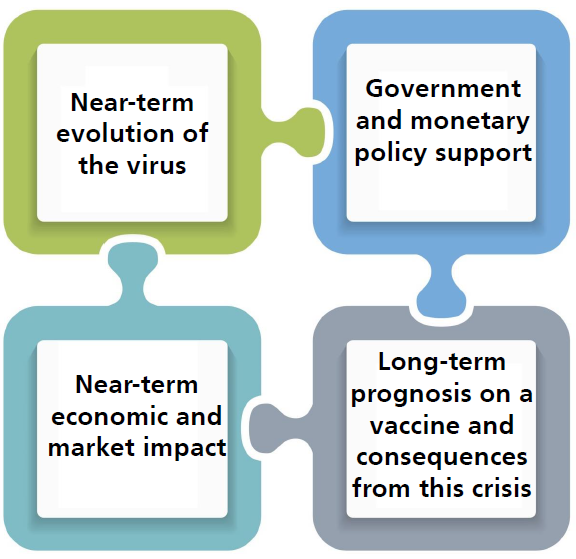

A timeline of how economies are responding

Source: Principal Asset Management, March 2020.

- More and more countries put in place unprecedented protective orders (e.g. non-essential business closures, stay-at-home regulations, etc.) – see Appendix. While these measures can seem negative, they will sow the seeds of an eventual recovery. Many businesses will choose to retain their employees if they know their business can reopen within a short, defined period as it is expensive and difficult to rehire quality talent.

- Governments around the world are unveiling or are planning very large fiscal stimulus to cushion the economic shock, e.g., US (10% of GDP), Japan (10%), Singapore (11%).

- Central banks have cut interest rates and unveiled a list of measures help to alleviate financial market stress.

Equity perspective: We are positioning the equity funds to be able to rebound when this pandemic is over. There is a possibility that governments and central banks will not quickly scale back their presence in markets and the economy once this downturn passes. Fiscal policy could work hand in hand with monetary policy, e.g., central banks could monetise a vast increase in government spending. Government spending may in turn be pumped directly into the hands of people and companies in need.

Some things to look for in the future:

- Industry consolidation within certain industries like auto manufacturing, restaurants, retail, and airlines.

- Enhanced popularity of emerging trends, such as online shopping, grocery and food ordering, online fitness platforms, etc.

What to do: Owning a diversified and balanced portfolio of fixed income and equities is sensible. We prefer Asian to global equities as the former would recover faster from the virus outbreak.

- For those invested in equities: Fight the emotions typically caused during pronounced market volatility and do not to react rashly to the barrage of negative news and sentiment.

- For those on the sidelines: Investing in bite sized amounts into equities over a period of time may be psychologically easier to do. If the market falls further, you would still have cash to buy. And if it rallies, you would not feel as much regret about having missed the rally completely.

Appendix

Selective countries, states and cities in lockdown because of the Covid-19 pandemic

| Country /States/ Cities | Date implemented |

| North America | |

| US (no nationwide lockdown) States (31 in lockdown): California, New York, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, Oklahoma, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Virginia, Washington DC, Washington State, West Virginia, Wisconsin, Colorado, Atlanta, Kentucky |

California, Pennsylvania (Mar 19), Texas (Mar 21), New York (Mar 22), Virginia, Washington DC (Mar 25) |

| Canada (no nationwide lockdown) Provinces (3 in lockdown): Quebec, Nova Scotia, Ontario |

Quebec, Nova Scotia, Ontario (Mar 23) |

| Europe and Nordic countries | |

| Italy | Mar 9 |

| Spain | Mar 14 |

| France | Mar 17 |

| Germany | Mar 22 |

| UK | Mar 23 |

| Austria | Mar 16 |

| Poland | Mar 24 |

| Belgium | Mar 18 |

| Netherlands (no nationwide lockdown) * Covid-19 under control | |

| Portugal | Mar 19 |

| Denmark | Mar 11 |

| Finland (no nationwide lockdown) Region: Uusimaa (lockdown) |

Mar 26 |

| Switzerland (no nationwide lockdown) | |

| Sweden (no nationwide lockdown) | |

| Asia Pacific | |

| Japan (no nationwide lockdown) * Covid-19 under control | |

| Australia | Mar 23 |

| New Zealand | Mar 26 |

| India | Mar 24 |

| China (no nationwide lockdown) * Covid-19 under control | Hubei (Jan 23, to be lifted on April 8) |

| Indonesia (no nationwide lockdown) Jakarta and 6 provinces, i.e., Yogyakarta, West Java, East Java, Banten, West Kalimantan, East Kalimantan (state of emergency) |

Jakarta (Mar 20) |

| Philippines (no nationwide lockdown) Luzon (in lockdown) |

Luzon (Mar 16) |

| Vietnam (no nationwide lockdown) * Covid-19 under control | |

| Myanmar (no nationwide lockdown) * Covid-19 under control | |

| Singapore (no nationwide lockdown) * Covid-19 under control | |

| South Korea (no nationwide lockdown) * Covid-19 under control | |

| Taiwan (no nationwide lockdown) * Covid-19 under control | |

| Thailand | Mar 26 |

| Malaysia | Mar 16 |

Source: Various news reports.

Prepared by Christopher Leow.

This document is intended to be educational in nature and is not intended to be taken as a recommendation to purchase products of Principal Asset Management Berhad.

Investing involves risk, including possible loss of principal. Asset allocation and diversification do not ensure a profit or protect against a loss.

Performance of indexes reflects the unmanaged result for the market segment the selected stocks or bonds represents. There is no assurance an index-based investment option will match the performance of the index tracked.

Click here to read or download in PDF.